Dissecting the GCC healthcare landscape

While the entire GCC is advancing, a closer look at key markets reveals distinct profiles that are crucial for identifying future opportunities.

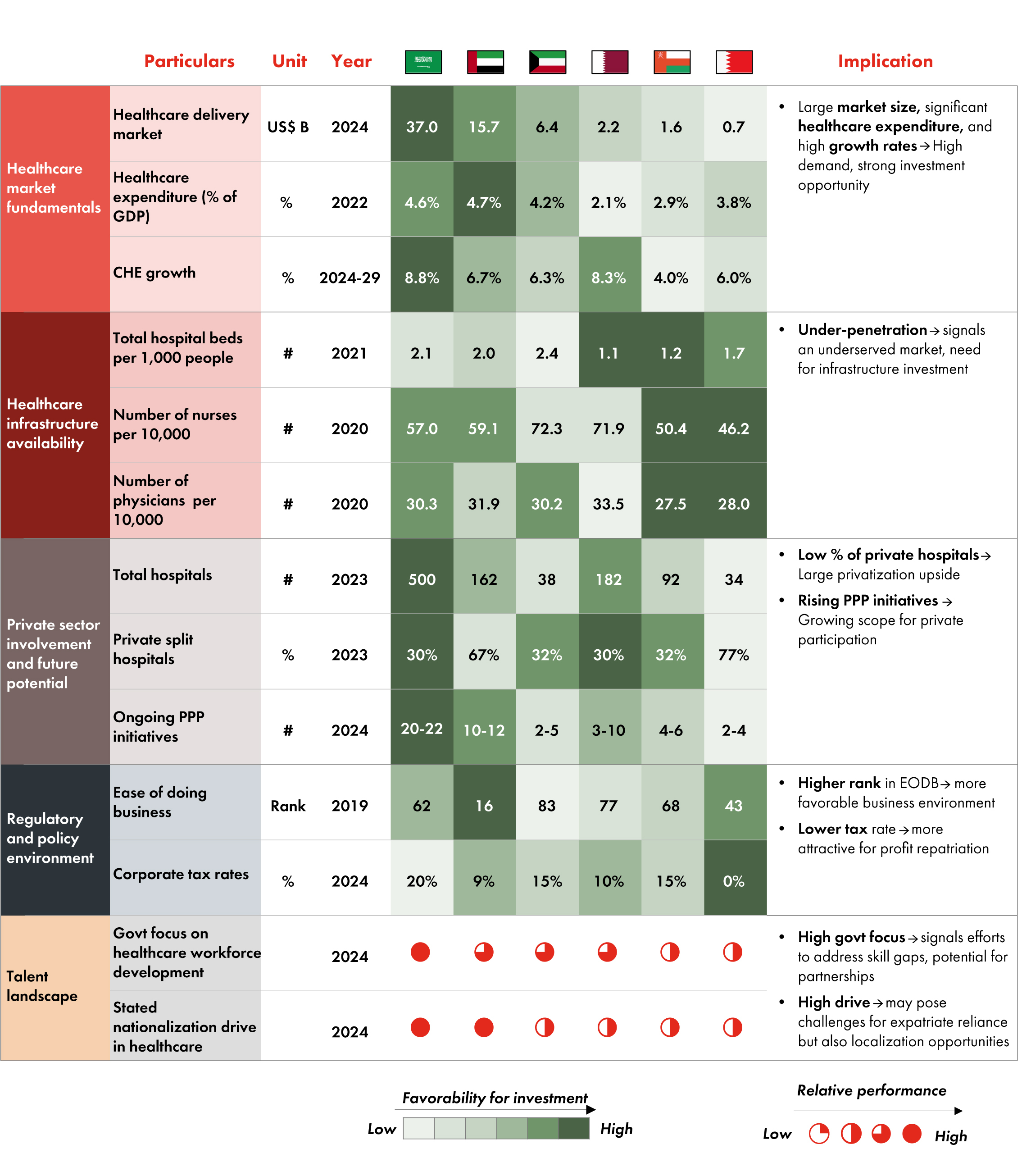

Exhibit 1: Regional comparison among GCC countries

- Market scale & growth momentum:

- KSA (US$ 37.0B market in 2024) and the UAE (US$ 15.7B) are the current giants

- However, KSA is projected to exhibit the highest healthcare expenditure CAGR at 8.8%, significantly outpacing the UAE (6.7%), Qatar (8.3%), and Kuwait (6.3%). This positions KSA as the primary engine of regional growth

- Infrastructure gaps & investment imperatives:

- Most GCC nations show under-penetration in hospital beds per 1,000 people compared to developed benchmarks

- This under-penetration across the region signals a broad, underlying need for continued infrastructure investment and capacity enhancement

- Private sector dynamism & untapped potential:

- The UAE stands out with a mature private sector (67% private hospital split)

- In stark contrast, KSA (30 % in private hospital split), Kuwait (32%) and Qatar (30%) offer significant privatization update

- Crucially KSA leads decisively in leveraging Public Private Partnerships (PPPs) with 20-22 ongoing initiatives, for exceeding other GCC nations (UAE: 10-12, others: 2-10)

Why KSA is becoming the region's healthcare delivery destination

While opportunities exist across the GCC, KSA distinguishes itself through an unparalleled combination of market scale, urgent unmet needs and a transformative, state driven agenda (Vision 20230). It's high healthcare expenditure growth, the sheer volume of required infrastructure investment(~ 30,000+ beds, 175K professionals by 2030), and an aggressive privatization plan (targeting a shift in hospital bed capacity from 23% to 68% private) create a unique gravitational pull for investment and strategic participation. This is further amplified by a strong government commitment to making healthcare a central pillar of it's economic diversification.

Strategic imperatives for KSA – Where to play

KSA'S healthcare transformation- anchored in Vision 2030- is reshaping the sector through privatization, digitiilzation and capacity expansion. This ambitious shift is unlocking strategic opportunities for investors, providers, tech players,manufacturers and educators to participate in one of the region's fastest-evolving healthcare markets:

- For healthcare delivery:

- Addressing the capacity gap: Focus on developing a significant portion of the ~30,000 needed beds through new hospitals and expansions, targeting undeserved regions and growing urban peripheries

- Specialized centers of excellence: High-demand areas like oncology, cardiology, diabetes management, rehabilitation, and long-term care (LTC) facilities, driven by the NCD burden (66% of deaths in KSA)

- PPP engagement: Target the 290 hospitals and 2,300 primary healthcare centres (PHCs) slated for privatization; focus on operational turnarounds and service expansion

- Anchoring new medical cities: Participate as a key developer or operator in KSA's large-scale medical city projects, contributing to integrated health hubs with diverse facilities

- For diagnostics chain:

- Comprehensive laboratory networks: Establish reference labs and networks of satellite/ feeder labs, including integration with the 2,300 privatizing PHCs

- Advanced modalities: Invest in genomics, molecular diagnostics, digital pathology, and specialized esoteric testing capabilities to support the national push towards personalized medicine and advanced diagnostics, catering to CoEs and specialized hospital needs

- Point-of-Care Testing (POCT): Deploy POCT solutions in PHCs and remote settings to improve access and turnaround times

- For MedTech & Pharma:

- Advanced medical equipment: Capitalize on KSA's massive infrastructure drive by becoming a preferred supplier of advanced medical equipment (Diagnostic imaging, surgical robots, ICU equipment, and laboratory automation) for new and upgraded facilities

- Digital health solutions: Platforms for EHR/EMR, health information exchange (HIE), AI-driven diagnostics, remote patient monitoring, and population health management

- Pharmaceuticals: Secure market access for innovative patented medicines for prevalent NCDs, and explore opportunities in local manufacturing for generics and biosimilars under localization mandates

- For investors (PE/VC):

- Privatized healthcare assets: Equity in hospitals, PHC networks, and ancillary services (labs, radiology) divested by the public sector

- HealthTech innovation: Scalable solutions in AI/ML for diagnostics and predictive analytics, telehealth platforms focusing on chronic care, and digital tools enhancing operational efficiency for providers

- Specialized services & supply chain: Investments in niche clinical services with unmet demands (e.g., mental health, home healthcare, LTC) and healthcare-specific logistics/cold chain

Conclusion:

The GCC healthcare landscape is dynamic, offering diverse avenues for growth. However, Saudi Arabia's current trajectory- driven by the sheer scale of it's Vision 2030 ambitions, profound infrastructure and service gaps,and an aggressive, policy-backed privatization agenda- presents a time-sensitive and uniquely compelling concentration of opportunity. While challenges in execution exist, the confluence of high-growth forecasts, massive investment requirements, and government commitment creates a window for strategic entry and expansion. The transformation is underway, and time to shape it's future- and secure a leading position within it- is now.