To

truly future-proof an investment, a deep dive into the target company's

technological core is paramount. This involves a comprehensive analysis of its

systems, data, and the people behind them to understand product-market fit,

operational efficiency, and long-term viability. This analysis examines the

entire digital ecosystem, from the core tech infrastructure to user-centric

metrics like daily and monthly active users (DAUs/MAUs), customer loyalty, etc.

This holistic view provides a clear picture of the company’s ability to retain

customers, attract new ones, and grow sustainably.

For

a PE firm considering an investment in a Southeast Asia-based EdTech company,

this deep analysis was critical. Praxis Global Alliance’s Tech DD approach,

which is designed to validate an app's user base and engagement, went beyond

surface-level metrics. It provided a detailed assessment that helped the client

understand the company's user behavior, geographic spread, customer engagement

metrics and effective user count, including both paid and free users. This

level of insight allows investors to make informed decisions and build a

strategic roadmap for the company's technological evolution.

Unlocking

scalability through tech

Scalability is a cornerstone of modern business, and it is directly tied to the underlying technology infrastructure. A comprehensive Tech DD evaluates whether a company’s architecture can handle growing user loads and business demands without significant bottlenecks. This includes assessing the technology stack for cross-platform compatibility, its popularity within the industry, and the use of in-house versus cloud solutions or shared resources between applications. Through this analysis, it was observed that a strong technology backbone enables the system to handle 1.5-2x peak demand with minimal increase in latency. This ensures stability during demand spikes and demonstrates the company’s readiness for growth, giving investors confidence in the operational scalability and resilience of the business.

At

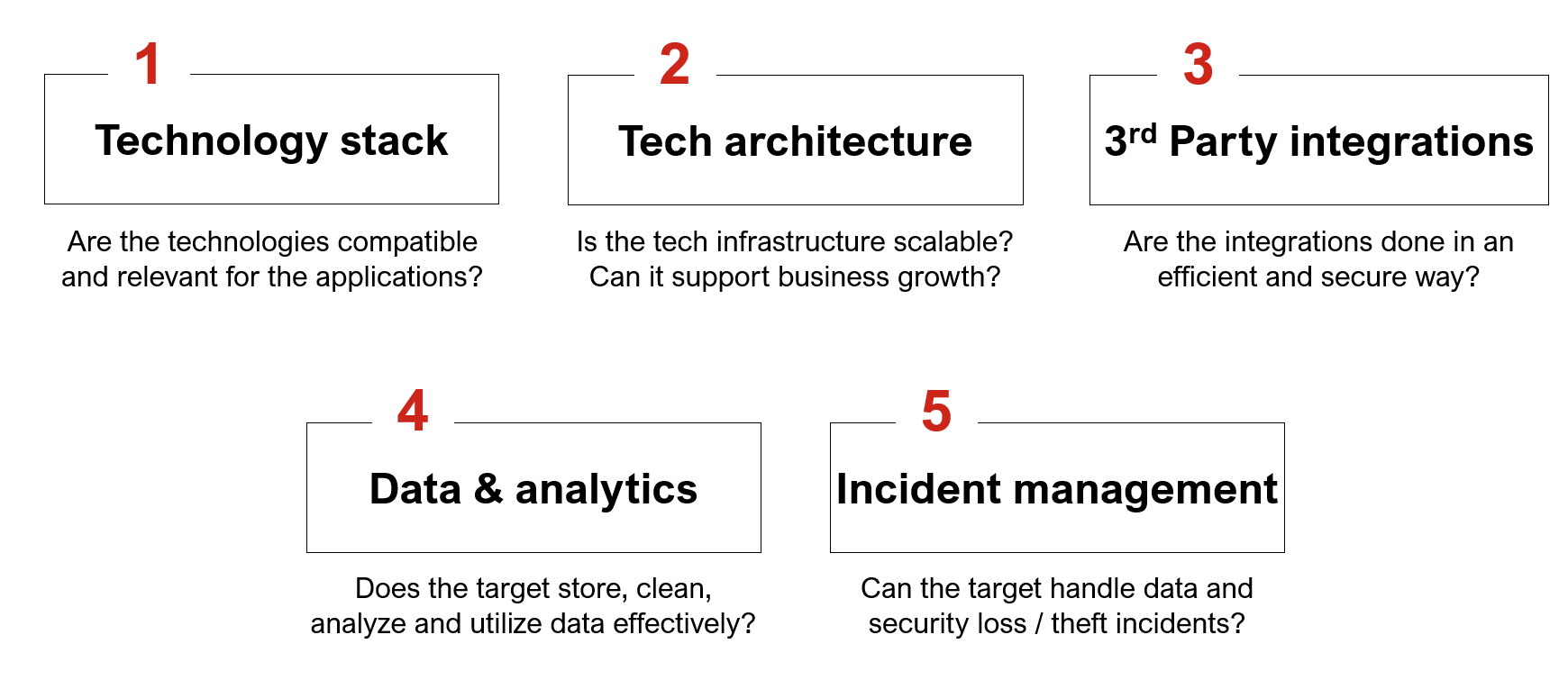

Praxis Global Alliance, our Tech Architecture Assessment framework is a

powerful tool for this purpose. It helps evaluate the scalability and

robustness of a company's technical infrastructure, focusing on key parameters

like the technology stack, third-party integrations, and data analytics

capabilities. This framework allows for a structured evaluation of server load

capacity, bandwidth, and upload/download speeds. By understanding these

elements, investors can identify potential roadblocks to growth and formulate a

plan to address them, ensuring the business can scale efficiently.

Tech architecture assessment framework: Key parameters to assess the scalability & robustness of underlying infrastructure

Mitigating risks in tech-led businesses

Mitigating risks in tech-led businessesThe digital realm introduces a unique set of risks that must be carefully managed to protect an investment. Beyond technical debt, which can hinder future development and innovation, another risk for PE investors is the potential for an application to fail under increased user demand, a direct threat to scalability. Tech DD helps mitigate this by scrutinizing a company's architecture to identify and address bottlenecks before they become critical. Additionally, a crucial part of the process is evaluating the technical team's ability to handle issues like server outages and other incidents. A Tech DD assesses their procedures, training, and SOPs to ensure a capable team is in place to manage these risks.

Furthermore, risks related to data and network security are paramount. A Tech DD mitigates these by scrutinizing a company's data and network security protocols, including encryption, access management, and incident response procedures. This helps protect against vulnerabilities and operational risks like server outages. At the data level, our analysis is performed directly on client servers using real-time data to ensure its sanctity and reliability. This multi-faceted approach, often leveraging tools like SQL, R, and Python, provides a reliable basis for analysis and insights. By addressing these technical and data-related risks upfront, PE investors can protect their capital and build a more resilient investment thesis.

Conclusion

In conclusion, a comprehensive technology due diligence is a strategic imperative that goes beyond the surface-level financial health of a company. It provides a holistic view of the technology and its potential to drive future growth, enable scalability, and mitigate inherent risks. By leveraging expert frameworks and data-driven insights, investors can confidently navigate the complexities of the digital economy, making smarter decisions that not only protect their capital but also unlock new avenues of value creation.