All major teams including sales, operations, and credit sit within the branch. Branch managers or credit managers are empowered to approve loans up to defined ticket sizes, enabling faster local decision-making.

This model decentralizes customer-facing functions to spokes (branches), while central hubs handle backend-heavy and selective customer-facing tasks. It enables branches to stay lean and agile while hubs ensure standardization and oversight.

This model limits physical infrastructure with branchless sourcing and centralized processing. Field teams are embedded at retail outlets or dealerships to source business, while the central office handles all backend processing. It works well for small-ticket and high-volume loans.

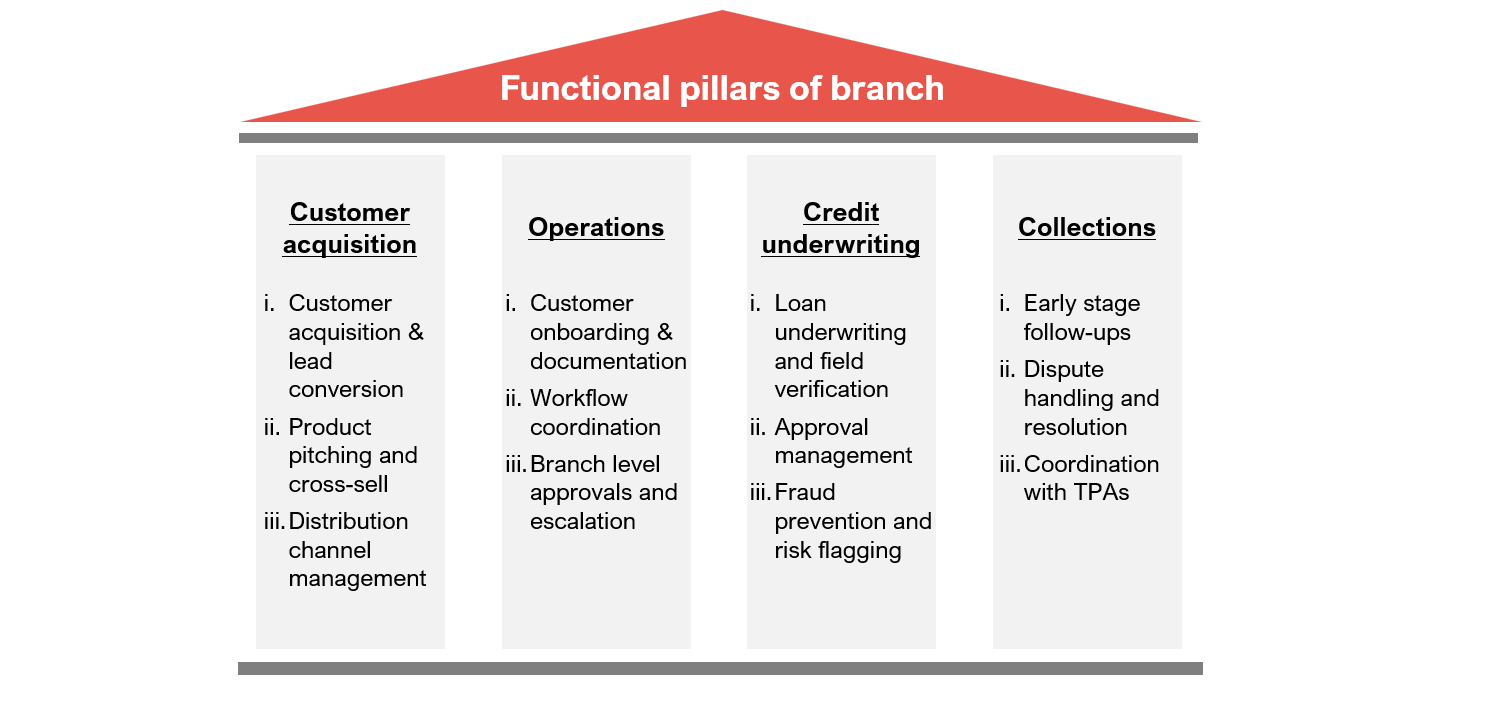

3. Structuring branch functions to improve

productivity

With the operating model in place, the next

focus is on how key branch functions are structured for performance. Branches

are built around four critical functional pillars: Customer acquisition, operations,

credit underwriting, and collections. Each of these must be clearly structured

to enable faster decision-making, accountability, and consistency across

markets.

Exhibit 2: Four critical pillars

of a branch

3.1 Customer acquisition: Sales teams drive

customer acquisition, and their design must match the market’s pace and profile

to ensure both agility and cost efficiency.

3.1 Customer acquisition: Sales teams drive

customer acquisition, and their design must match the market’s pace and profile

to ensure both agility and cost efficiency.In-house DSTs offer better control and lead

quality, especially in high-volume markets, though they come with higher fixed

costs. DSAs and local connectors help expand reach in rural and semi-urban

markets at lower fixed costs, but offer limited control on lead quality. Sales

structures vary by geography, with metro branches often operating leaner,

DST-heavy setups, while rural branches rely more on external partners for wider

reach.

Can Fin uses a blended model, with ~50% of

sourcing through DSAs and rest via in-house DSTs, whereas HFFC relies entirely

on external channels such as DSAs and connectors for originations.

3.2 Operations: Branch operations must be designed to prevent service delays and ensure efficient branch

throughput.

Defined spans of control help avoid managerial

overload, strengthen the frontline, and improve overall effectiveness. Clear

reporting structures reduce ambiguity and enable faster issue resolution

through timely escalations. Function-wise task allocation minimizes duplication

and ensures a smoother, more streamlined service flow.

3.3 Credit underwriting: Efficient credit

workflows improve TAT without compromising underwriting standards. Branch

credit functions must be clearly defined and empowered.

AI-led Business Rule Engines (BREs) enable

instant approval of smaller loans, freeing up manual bandwidth for complex

cases. For instance, L&T Finance’s Project Cyclops uses AI and alternate

data, including geolocation, to underwrite first-time borrowers and has

improved new-to-credit (NTC) loan approvals by 34%. To maintain risk control,

approval limits are tiered by ticket size and borrower credit history, while

high-value or complex loans are routed to central teams for additional

scrutiny.

3.4 Collections and recovery:

Effective collections

require

speed in early stages and scale as delinquencies rise.

Early-stage follow-ups are handled in-branch

to preserve customer relationships and enable faster resolution. After defined

delinquency threshold limits, Third-Party Agencies (TPAs) can be involved to

take over recovery. This phased approach allows internal teams to focus on

relationship-led collections in early buckets, while agencies take over

higher-volume, late-stage buckets more aggressively.

Religare Finvest Limited (RFL) deployed FinnOne

mCollect solution, achieving ~90% field penetration and per-receipt cost came

down to 30% of prior expenses.

4. Key success factors driving branch productivity

Sustainable branch performance across

functional pillars depends on operational discipline. By combining process

standardization with agile execution, NBFCs can ensure faster service, fewer

errors, and stronger customer experience.

Exhibit 3: Key success factors

that drive branch productivity

5. Conclusion: Smarter branch ops for scalable

impact

The future of branch-led growth lies not just in

expanding headcount or square footage, but in building lean, responsive, and

tech-integrated operating models. Leading NBFCs are adopting fit-for-purpose

operating models, structuring key functions for speed and accountability, and embedding

process discipline with real-time performance tracking. Branches that balance

autonomy with central oversight, hire and retain the right talent, and follow

standardised yet agile workflows are better placed to scale sustainably.

To stay competitive, NBFCs must rethink their branch

operating playbook, designing branches as modular, data-enabled units that

deliver speed without compromising control. Retaining the right talent is

critical, as new hires often take 6-8 months to operate at full potential,

making churn a hidden cost. It’s not about doing more but doing it smarter.

6. Design your branch strategy with Praxis

Exhibit 4: Capabilities we build

and implement